Tourism Lone Champion for Coos Economy: Is It Enough?

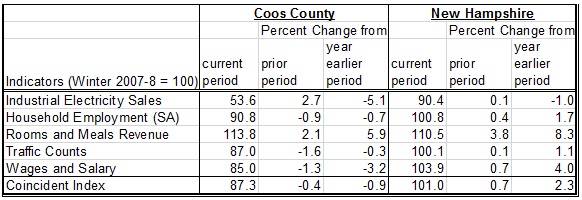

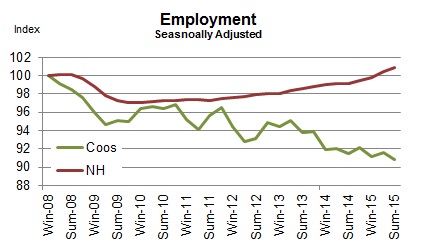

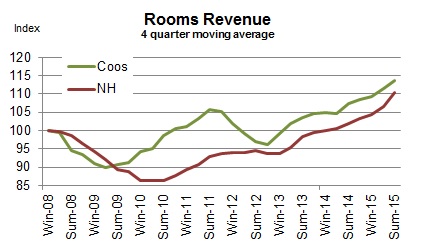

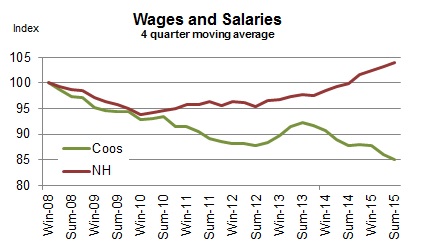

The Coos economy’s reliance on traveler spending has deepened during summer 2015. While the tourism industry’s contribution to the region’s economy is vital, it may need some help. The revised data show that the County Index decreased six quarters in a row. The tourism sector remained strong, and the year-over-year percentage increase in spending at lodgings rose for the 10th consecutive quarter. However, the rest of the economy struggled. The labor market showed troubling signs. The County’s unemployment rate of 3.9%, the lowest for August since 2007, disguises the seriousness of the unemployment situation. The seemingly remarkable unemployment statistic was a result of the aging population and net out-migration, rather than job growth. The County’s labor force has drastically declined since 2010, marking a near 8% decline. This appears to be a matter of the lack of job opportunity. Wages and salaries decreased for the sixth consecutive quarter on a year-over-year basis. The County’s housing market continued to stabilize, as the pace of declines in median home prices was the slowest since spring 2014, and the volume of home sales increased three straight quarters.

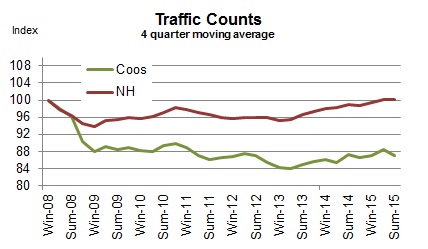

The state’s economic growth gained momentum during summer 2015. The State Index increased for the 20th straight quarter on a year-over-year basis. The pace of increases in the Index was the fastest since the Great Recession. Four out of the five component indicators were up compared to the same period in 2014. The labor market continued to expand; the number of employed residents grew at a pace unseen since the Great Recession. The tourism sector remained strong; both the average Saturday vehicle traffic counts and spending at lodgings were up from the same period a year earlier. The state’s housing market revitalized; the volume of home sales bounced back to a double-digit growth and the pace of increases in median home prices rose two straight quarters. Three of the four state leading indicators remained up.

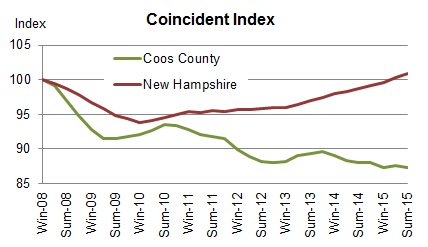

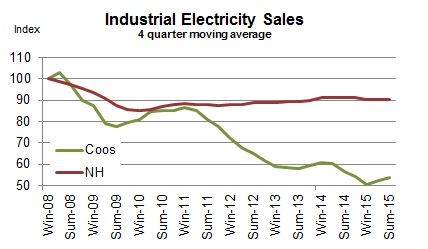

Coincident Index

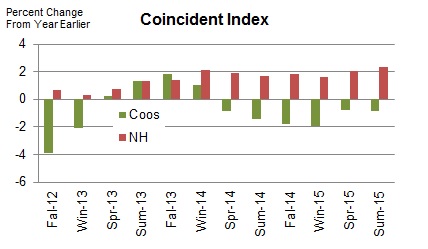

The Coos Coincident Index, which tracks the current state of the Coos economy, inched down to 87.3 in Summer 2015 from Spring’s revised value of 87.6. On a quarterly year-over-year basis, the Index decreased for the sixth quarter in a row.

The Coos Coincident Index, which tracks the current state of the Coos economy, inched down to 87.3 in Summer 2015 from Spring’s revised value of 87.6. On a quarterly year-over-year basis, the Index decreased for the sixth quarter in a row.

The New Hampshire Coincident Index rose to 101.0 in Summer 2015 from Spring’s revised value of 100.3. On a quarterly year-over-year basis, the Index increased for the 20th consecutive quarters.

The New Hampshire Coincident Index rose to 101.0 in Summer 2015 from Spring’s revised value of 100.3. On a quarterly year-over-year basis, the Index increased for the 20th consecutive quarters.

How strong are the forces of change?

In Summer 2015, the Coos Coincident Index decreased six straight quarters on a quarterly year-over-year basis. Four of the five component indicators turned down from their Summer 2014 levels. The pace of declines picked up slightly from Spring 2015, but remained low compared to recent trend. The State Index increased for the 20th quarter in a row on a quarterly year-over-year basis. Four out of the five component indicators remained up from a year ago. The pace of growth was the fastest since the Great Recession.

Household Employment

Household employment measures the number of employed residents. In contrast to non-farm payroll employment that is more commonly used in the national and state indexes, household employment includes self-employed, unpaid domestic help and both farm and non-farm workers, all of which may be more significant in rural than urban economy. Employment tends to rise as economy grows.

Rooms Revenue

Rooms Revenue

Rooms revenue represents spending on accommodations paid by travelers. It’s an important indicator for the tourism sector; it’s not an estimate but an official count as reported by the New Hampshire Department of Revenue Administration. However, it may not fully reflect changes in the overall activity level in the tourism sector. Although it tracks a majority of overnight travelers, it excludes day travelers and overnight travelers staying with friends and family and those who have second homes. However, this drawback may be less of a concern in the northern regions of the state where day travelers are a small minority due to the distance from the major urban areas.

Traffic Counts

It tracks the average vehicle traffic counts on Saturdays each quarter, which is automatically collected from traffic recorders located throughout the State. 12 recorders are selected to reflect traveler traffic in each of the seven travel regions in the State with two recorders from Coos County – Jefferson and Northumberland.

Wages and Salaries

Wages and Salaries

The estimated wage and salaries disbursements represent total compensation including pay for vacation, bonuses, stock options, and tips. This data is obtained from all workers covered under state and federal unemployment insurance laws; in other words, it is full population counts, not sample-based estimates. Unlike the household employment report, however, it excludes self-employed, domestic workers, and most agricultural workers. For this difference, wages and salaries series complements the number of employed residents in monitoring the labor market conditions as well as the economy. A change in wages and salaries, adjusted for inflation, may reflect changes in the number of jobs, the ratio between part-time and full-time jobs, and wage rates.

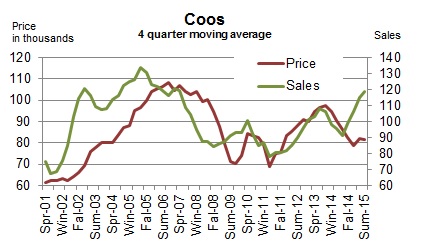

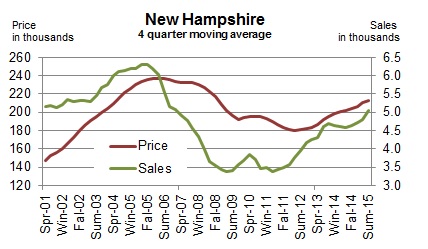

Industrial Electricity Sales

It measures sales of electricity (kWh) to industrial customers. Utilities categorize consumers based on the North American Industry Classification System, demand, or usages. The industrial sector includes manufacturing, construction, mining, agriculture, fishing, and forestry establishments. Among these industries, manufacturing is a primary industry in Coos County making up 69% (73% for New Hampshire in 2008) of the total number of jobs in the industrial sector mentioned above according to the 2006 QCEW data. Therefore, a rise in industrial electricity sales may largely indicate invigorating manufacturing activities in the economy.

Real Estate

NCEI reports two real estate market indicators – home sales and median home prices. The data tracks residential homes sold, including condos and manufactured homes. The health of the real estate sector is important to the broad economy due to its multiplier effect. Home transactions not only generate income for real estate brokers and mortgage bankers but also bring more businesses in other sectors including moving services, home furnishings and appliances. In order to minimize volatility in Coos real estate market, indicators are averaged over a four quarter period.

Coos County

Coos County

The County’s housing market continued to stabilize during summer 2015. The pace of declines in median home prices, smoothed by four quarter moving average, decreased two straight quarters on a year-over-year basis. The volume of home sales, smoothed by four quarter moving average, rose three straight quarters on a year-over-year basis at an increasingly faster pace.

New Hampshire

The state’s housing market had a busy summer. The volume of home sales, smoothed by the four-quarter moving average, bounced back to a double-digit growth on a year-over-year basis. The pace of increases in median home prices, smoothed by four quarter moving average, rose two consecutive quarters.

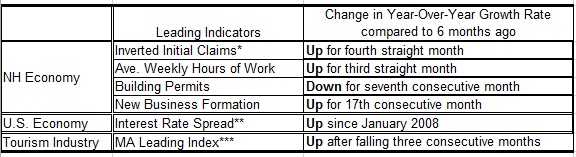

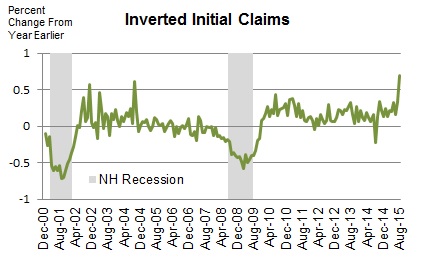

Leading Indicators

Leading indicators are to provide a sense of future economic conditions in the state of New Hampshire. The report includes six leading indicators grouped into three different categories – 1) four leading indicators for the broad economy of New Hampshire; 2) a leading indicator of the state’s tourism industry; 3) a leading indicator of the U.S. economy. The list of leading indicators for New Hampshire’s economy includes initial unemployment claims, average weekly hours of work in the total private sector, building permits, and new business formation; the state’s tourism industry has the Massachusetts Leading Index published by the Philadelphia Federal Reserve Bank; the report also includes interest rate spread between 10-year Treasury and federal funds for the U.S. economy. Although the list is by no means exhaustive and indicators often do not go back long enough in time for statistically robust analysis, we believe it can still be a helpful tool. Raw data are processed so as to make it easier to detect a change in the direction of the underlying trend in the economy. In the summary table below, “up” during recession indicates recovery around the corner while “down” during an expansion signals an impending recession. During expansion, the likelihood of recession increases when more indicators turn down persistently. For example, all four leading indicators of NH economy start posting “down” month after month at the beginning of the state’s 2008 recession. The New Hampshire recessions are defined as the period of declines in the New Hampshire Coincident Index published by the Philadelphia Federal Reserve Bank.

In August 2015, three of the four New Hampshire leading indicators were up compared to six months ago in their year-over-year growth rate.

*This series is inverted so that an “up” means an improvement. Layoffs decrease (inverted layoff increases) when the labor market conditions improve.

**”Up” or “down” is a change in the spread from prior month.

***”Up” or “down” is a change in the Index from six month ago.

Initial Unemployment Claims

Initial Unemployment Claims

The series is inverted so that an increase means an improvement. Initial claims decrease (inverted initial claims increase) when the labor market condition improves. The number of Initial claims tends to lead the business cycle. The chart demonstrates that it correctly predicted both the beginning and the ending of the past two recessions.

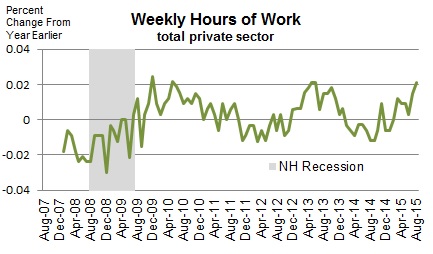

Average Weekly Hours of Work in Private Sector

It tends to turn before the economy does because employers often increase work hours of existing workers at the beginning of the recovery before committing to new hires; they do not want to take the risk of committing to new hires and seeing the economy fall back again. This data for New Hampshire only goes back to 2007.

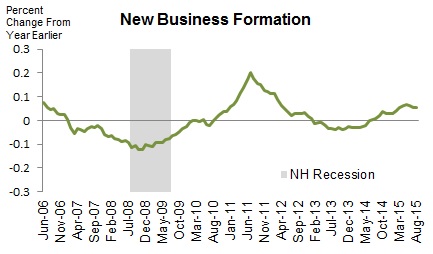

New Business Formation

New Business Formation

All companies that want to do business in the state must register at the NH Secretary of State. This data includes all types of businesses including corporations and limited liabilities companies. The number of new businesses tends to lead the business cycle. Although this series goes back only to 2006, it correctly predicted the beginning and ending of the state’s 2008 recession. The series is smoothed by 12 month moving average.

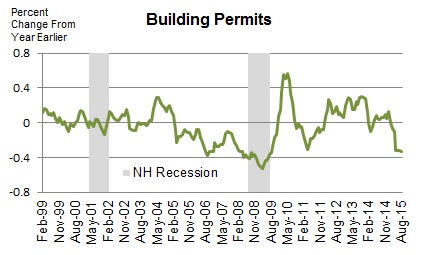

Building Permits for Single Family Homes

It’s often the case housing recovery leads the broad economy out of recession. This is because of its extensive ripple effect over the rest of the economy. Building construction requires inputs from many other industries such as window manufacturing, logging, plumbing, electricity services, banking, and home furnishings such as consumer electronics and furniture. The 2001 recession was a mild recession and a rare one that did not involve a housing slump. The series is smoothed by four month moving average.

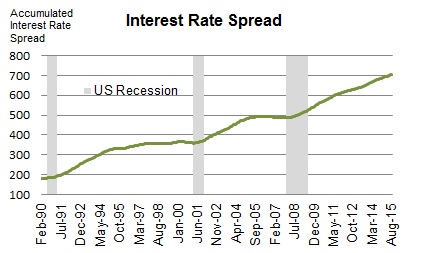

Interest Rate Spread

The interest rate spread, the 10 year Treasury less the Federal Funds, is considered one of the best leading indicators for the national economy. The indicator is the sum of all the past values plus the spread in the current period. Therefore, it decreases when the current spread is negative (the 10 year T rate is lower than the Fed Funds Rate), which is indicative of an impending recession.

Massachusetts Leading Index

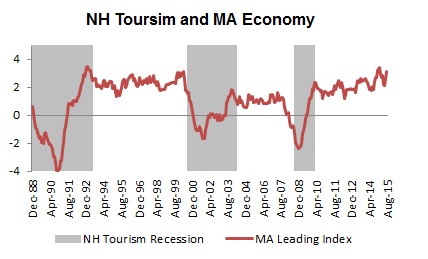

The state of Massachusetts economy is critical for the New Hampshire’s tourism industry, since the largest share of visitors to New Hampshire come from Massachusetts. Therefore, the Massachusetts Leading Index may also shed light on the future performance of the New Hampshire’s tourism industry. The MA Leading Index is published by the Philadelphia Federal Reserve Bank. A New Hampshire tourism recession was defined as a period of declines in the year-over-year growth of real spending at lodgings.

Technical Notes

- Employment is the number of people employed from the household survey.

- The current values of rooms and meals revenues are estimated using the data obtained from participating local hoteliers.

- The data series reported in the dollar values are adjusted for inflation.

- Real Estate data is obtained from the Northern New England Real Estate Network (NNEREN). All analysis and commentary related to the statistics is that of the authors, and not that of NNEREN.

© Copyright 2010: Daniel Lee and Vedran Lelas, College of Business Administration, Plymouth State University.