Tourism Boost Recovery

[innerindex]In Spring 2013, there were encouraging signs in the economy. The Coos Index rose from Winter 2013. This quarterly increase from prior season was the first time since summer 2010. On a quarterly year-over-year basis, while the Index continued to decline, the pace of declines decreased for the second consecutive quarters. Two of five component indicators turned up from Winter 2013. The boost came from the tourism industry. The better-than-average snow season rejuvenated the North Country’s winter sports industry, particularly skiing and snowmobiling. The increase in the tourism activity was huge, particularly when compared to Spring 2012, which was one of the warmest springs in recent memory. As a result, the labor market was much stronger; the number of employed residents increased by the fastest rate that had not been seen since the Great Recession began. The housing market continued its recovery, while there were some signs that the housing market rebound might be slowing.

The overall picture of the State’s economy looked more positive in spring 2013 than in winter 2013, although it still remained far from being a vibrant economy that everyone has been waiting for. Although at a crawling pace, the revised State Index did increase for the 11th consecutive quarters on a quarterly year-over-year basis. Four of five component indicators turned up compared to a year ago. The largest contribution came from the tourism industry. Snowy March and April brought businesses to the state’s ski and snowmobile industry. Spending for lodging was up from Spring 2012. The labor market showed encouraging signs as well; the pace of increases in the number of employed residents rose for the first time since Winter 2012 on a quarterly year-over-year basis. In addition, leading indicators for the state of New Hampshire seem to indicate a brighter economy ahead; three of the four state leading indicators remained up. The state’s housing market remained on the rebound as well; the median home price increased at a rate faster than Winter 2013, while the pace of increases in the volume of home sales slowed two quarters in a row.

Student Report by Ryan Bernier

The Hospitality and Tourism Management Program: Preparing Local Students for the Business of Life

As many parts of rural America continue to recover from the gradual but steady decrease in manufacturing jobs, over the past few decades, other industries have increased in prominence. Due to the beautiful natural surroundings and recreational opportunities that the White Mountains region offers to travelers, there is always one industry which has the potential to thrive – the hospitality industry. Due to this realization about regional labor market trends 12 years ago, a partnership was formed between a local high school and one of the key grand resorts in the North Country, to train young people for a career in hospitality.

The Hospitality and Tourism Management Program is a partnership between the White Mountains Regional High School (WMRHS) and the Mountain View Grand Resort, a Triple-A Four Diamond resort in Whitefield, New Hampshire. The students who are accepted into this program gain an opportunity to learn all facets of the hospitality business, including but not limited to, the tourism industry, front-office management, facilities management, finance, housekeeping, food and beverage, communication, and the guest experience. Christopher Diego, Managing Director of the Mountain View Grand Resort has teamed up with Lisa Perras, an instructor at the WMRHS on this initiative. “The purpose of the program is to provide students with exposure but more importantly to help them figure out which profession is of interest.” Mr. Diego said. “Talking to and working with people who actually do the work allows students to figure out what they want to do and what they don’t want to do.”

Interested students go through an application process and are enrolled in the program once accepted. They receive course credit for their participation in the program. Students take classes at the Mountain View Grand Resort five days per week, where they carry out their academic activities in their own building equipped with a gorgeous panoramic view of the mountains. Mondays, Wednesdays and Fridays are spent in the classroom learning while Tuesdays and Thursdays are spent in the learning laboratory, gaining valuable hands on experience working in the hotel. The Mountain View Grand prides itself on training local talent and opportunities for employment and internships are available to the students who are enrolled in the program as well as for those who have graduated. Many students seize these opportunities.

The Hospitality and Tourism Management Program plays an important part in preparing its students for the challenges that they will face on the job by supporting and strengthening their skill set. The hospitality industry has been an important segment of the regional economy for years. However, because the industry requires work on weekends and holidays, people often decide to pursue a different career. “More and more people are realizing that hospitality is a huge economic force.” Mr. Diego explained. “It is becoming a reality that if young people want to stay in the North Country, hospitality has to become an option.”

The instructor of the program, Lisa Perras, is a former Curriculum Designer for the American Hotel and Lodging Educational Institute and a co-author of the text for used for the program. Like many residents, she is concerned about the economic vitality of Coös County. “Coös is socio-economically depressed. Many young people are under the impression that they don’t have what it takes to be at a place like the Mountain View.” Ms. Perras explained. “This program helps break this cycle by introducing students to an environment where a uniform is a great equalizer.”

Students who participate in the program gain experience by developing an understanding of how all facets of a hotel operate together to create a successful enterprise. “The program helps sensitize students to the fact that it is the guest who pays their check,” Mr. Diego said. If a student decides that hospitality is a field worth pursuing, he or she is given the tools needed to pursue his or her career. In the opposite scenario, if a student decides that hospitality is not the best fit, the program still teaches basic life skills regarding communication. Such skills include the importance of being a good listener, looking someone in the eye while talking, and managing social situations, all skills that have additional application outside of the work place.

Coincident Index

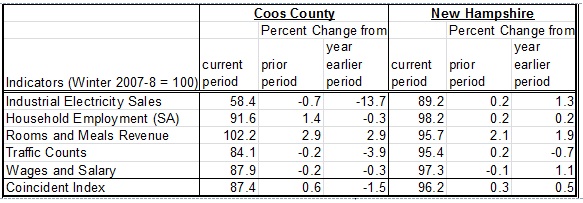

The Coos Coincident Index, which tracks the current state of the Coos economy, rose to 87.4 in Spring 2013 from Winter’s revised value of 86.9. On a quarterly year-over-year basis, the Index declined for the ninth quarter in a row.

The New Hampshire Coincident Index inched down to 96.2 in Spring 2013 from Winter’s revised value of 95.9. On a quarterly year-over-year basis, the index increased for the 11th consecutive quarters.

How strong are the forces of change?

In Spring, the Coos Coincident Index fell for the ninth quarter in a row on a quarterly year-over-year basis. Four of five component indicators remained down from their Spring 2012 levels. On a positive note, the pace of declines fell for the second quarter in a row. The State Index increased for the 11th quarter in a row on a quarterly year-over-year basis. Four of five component indicators were up from a year ago.

Household Employment

Household employment measures the number of employed residents. In contrast to non-farm payroll employment that is more commonly used in the national and state indexes, household employment includes self-employed, unpaid domestic help and both farm and non-farm workers, all of which may be more significant in rural than urban economy. Employment tends to rise as economy grows.

Coos County

Coos County

The employment index, adjusted for seasonal variation, contracted for the third time in five quarters. On a quarterly year-over-year basis, it fell for the ninth consecutive quarters.

New Hampshire

Employment at the state level, adjusted for seasonal variation, increased for the second quarter in a row. On a quarterly year-over-year basis, it continued to expand; but its pace of growth had declined four straight months.

Rooms Revenue

Rooms revenue represents spending on accommodations paid by travelers. It’s a good hospitality sector’s indicator in the sense that it’s not an estimate, but an official count as reported by the New Hampshire Department of Revenue Administration. However, it may not fully reflect changes in the overall activity level in the hospitality sector. Although it tracks a majority of overnight travelers, it excludes day travelers and overnight travelers staying with friends and family and those who have second homes. In the case of the northern regions of the state, the effect of the drawback is less of a concern since day travelers are a small minority due to the distance from the major urban areas.

Coos County

The estimated rooms and meals revenue, adjusted for inflation and smoothed by the four quarter moving average, increased for the first time since summer 2011. On a quarterly year-over-year basis, it fell four quarters in a row.

New Hampshire

The estimated rooms and meals revenue, adjusted for inflation and smoothed by the four quarter moving average, decreased for the third time in four quarters. On a quarterly year-over-year basis, it fell for the first time since Fall 2010.

Traffic Counts

It tracks the average vehicle traffic counts on Saturdays each quarter, which is automatically collected from traffic recorders located throughout the State. 12 recorders are selected to reflect traveler traffic in each of the seven travel regions in the State with two recorders from Coos County – Jefferson and Northumberland.

Coos County

Coos County

Average Saturday traffic counts, smoothed by the four quarter moving average, decreased three consecutive quarters. On a quarterly year-over-year basis, it declined two straight quarters.

New Hampshire

Average Saturday traffic counts, smoothed by the four quarter moving average, decreased for the second time in four quarters. On a quarterly year-over-year basis, it turned down for the sixth time in seven quarters.

Wages and Salaries

The estimated wage and salaries disbursements represent total compensation including pay for vacation, bonuses, stock options, and tips. This data is obtained from all workers covered under state and federal unemployment insurance laws; in other words, it is full population counts, not sample-based estimates. Unlike the household employment report, however, it excludes self-employed, domestic workers, and most agricultural workers. For this difference, wages and salaries series complements the number of employed residents in monitoring the labor market conditions as well as the economy. A change in wages and salaries, adjusted for inflation, may reflect changes in the number of jobs, the ratio between part-time and full-time jobs, and wage rates.

Coos County

The estimated wages and salary disbursement, adjusted for inflation and smoothed by the four quarter moving average, rose for the first time since Summer 2010. On a quarterly year-over-year basis, it continued to decline; but the pace of the declines fell for the fourth consecutive quarters.

New Hampshire

The estimated wages and salary disbursement, adjusted for inflation and smoothed by the four quarter moving average, decreased for the third time in four quarters. On a quarterly year-over-year basis, it decreased for the second time in four quarters.

Industrial Electricity Sales

It measures sales of electricity (kWh) to industrial customers. Utilities categorize consumers based on the North American Industry Classification System, demand, or usages. The industrial sector includes manufacturing, construction, mining, agriculture, fishing, and forestry establishments. Among these industries, manufacturing is a primary industry in Coos County making up 69% (73% for New Hampshire in 2008) of the total number of jobs in the industrial sector mentioned above according to the 2006 QCEW data. Therefore, a rise in industrial electricity sales may largely indicate invigorating manufacturing activities in the economy.

Coos County

Coos County

Industrial electricity sales, smoothed by four quarter moving average, fell for the 8th consecutive quarter. On a quarterly year-over-year basis, it fell for the 7th consecutive quarter.

New Hampshire

Industrial electricity sales, smoothed by the four quarter moving average, advanced five straight quarters. On a quarterly year-over-year basis, it expanded four quarters in a row.

Real Estate

NCEI reports two real estate market indicators – home sales and median home prices. The data tracks residential homes sold, including condos and manufactured homes. The health of the real estate sector is important to the broad economy due to its multiplier effect. Home transactions not only generate income for real estate brokers and mortgage bankers but also bring more businesses in other sectors including moving services, home furnishings and appliances. In order to minimize volatility in Coos real estate market, indicators are averaged over a four quarter period.

Coos County

In Spring 2013, the pace of rising home prices in Coos County remained on a downward trend. Median home prices, smoothed by the four-quarter moving average, rose at a rate less than half the rate during the same period a year ago, while increasing six straight quarters on a quarterly year-over-year basis. The pace of growth in home sales, smoothed by the four-quarter moving average, fell for the first time since the housing recovery began in Coos a year ago. Still, home sales rose five quarters in a row on a quarterly year-over-year basis.

New Hampshire

New Hampshire

The state’s housing market also showed early signs of slowing. The pace of growth in home sales, smoothed by the four-quarter moving average, decreased for the second quarter in a row. The median home price, smoothed by four-quarter moving average, increased two quarters in a row. However, the slowing home sales growth poses a threat to the sustainability of the housing recovery in the state, considering home sales tend to lead home prices.

Leading Indicators

Leading indicators are to provide a sense of future economic conditions in the state of New Hampshire. The report includes 7 leading indicators grouped into three different categories – 1) four leading indicators for the broad economy of New Hampshire; 2) two leading indicators of the state’s hospitality industry; 3) a leading indicator of the U.S. economy. The list of leading indicators for New Hampshire’s economy includes initial unemployment claims, average weekly hours of work in the total private sector, building permits, and new business formation; the list for the state’s hospitality industry has gas price, and Canadian dollar; the report also includes interest rate spread between 10-year Treasury and federal funds for the U.S. economy. Although the list is by no means exhaustive and indicators often do not go back long enough in time for statistically robust analysis, we believe it can still be a helpful tool. Raw data are processed so as to make it easier to detect a change in the direction of the underlying trend in the economy. In the summary table below, “up” during recession indicates recovery around the corner while “down” during an expansion signals an impending recession. During expansion, the likelihood of recession increases when more indicators turn down persistently. For example, all four leading indicators of NH economy start posting “down” month after month at the beginning of the state’s 2008 recession. The New Hampshire recessions are defined as the period of declines in the New Hampshire Coincident Index published by the Philadelphia Federal Reserve Bank.

In May 2013, three of the four leading indicators for New Hampshire were up compared to six months ago in their year-over-year growth rate.

*These series are inverted so that an “up” means an improvement. Layoff decreases (inverted layoff increases) when the labor market conditions improve; and a decrease in gas prices (an increase in inverted gas prices) may help increase the number of travelers. **”Up” or “down” in this series is a change from prior month as opposed to from 6 months ago. ***Building Permits is for April 2013 instead of May; the data wasn’t available for May at the time when this report was written.

Initial Unemployment Claims

Initial Unemployment Claims

The series is inverted so that an increase means an improvement. Initial claims decrease (inverted initial claims increase) when the labor market condition improves. The number of Initial claims tends to lead the business cycle. The chart demonstrates that it correctly predicted both the beginning and the ending of the past two recessions.

Average Weekly Hours of Work in Private Sector

It tends to turn before the economy does because employers often increase work hours of existing workers at the beginning of the recovery before committing to new hires; they do not want to take the risk of committing to new hires and seeing the economy fall back again. This data for New Hampshire only goes back to 2007.

New Business Formation

New Business Formation

All companies that want to do business in the state must register at the NH Secretary of State. This data includes all types of businesses including corporations and limited liabilities companies. The number of new businesses tends to lead the business cycle. Although this series goes back only to 2006, it correctly predicted the beginning and ending of the state’s 2008 recession. The series is smoothed by 12 month moving average.

Building Permits for Single Family Homes

It’s often the case housing recovery leads the broad economy out of recession. This is because of its extensive ripple effect over the rest of the economy. Building construction requires inputs from many other industries such as window manufacturing, logging, plumbing, electricity services, banking, and home furnishings such as consumer electronics and furniture. The 2001 recession was a mild recession and a rare one that did not involve a housing slump. The series is smoothed by four month moving average.

Interest Rate Spread

Interest Rate Spread

The interest rate spread, the 10 year Treasury less the Federal Funds, is considered one of the best leading indicators for the national economy. The indicator is the sum of all the past values plus the spread in the current period. Therefore, it decreases when the current spread is negative (the 10 year T rate is lower than the Fed Funds Rate), which is indicative of an impending recession.

Canadian Dollar

The value of Canadian dollar (the U.S. dollar per Canadian dollar) is an important indicator of the current and future tourism activity in the State of New Hampshire. Canada is the most important source of foreign travelers in the state. An increase in the value of Canadian dollar makes travel to the U.S. more affordable for Canadians. The chart on the right shows its recent relationship with spending on accommodations by travelers.

Gas Price

Gas Price

It’s the monthly average of weekly New England regular conventional retail gas prices. A significant decrease in gas prices makes traveling more affordable and can help increase the number of travelers to the state. When gas prices increase substantially, traffic counts tend to fall and vice versa. Gas prices are inverted so that an increase indicates improving conditions.

Technical Notes

- Employment is the number of people employed from the household survey.

- The current values of rooms and meals revenues are estimated using the data obtained from participating local hoteliers.

- The data series reported in the dollar values are adjusted for inflation.

- Real Estate data is obtained from the Northern New England Real Estate Network (NNEREN). All analysis and commentary related to the statistics is that of the authors, and not that of NNEREN.

© Copyright 2010: Daniel Lee and Vedran Lelas, College of Business Administration, Plymouth State University.