Foreign Firms Determine Value to Buyers in Key Segments of New Hampshire’s Economy

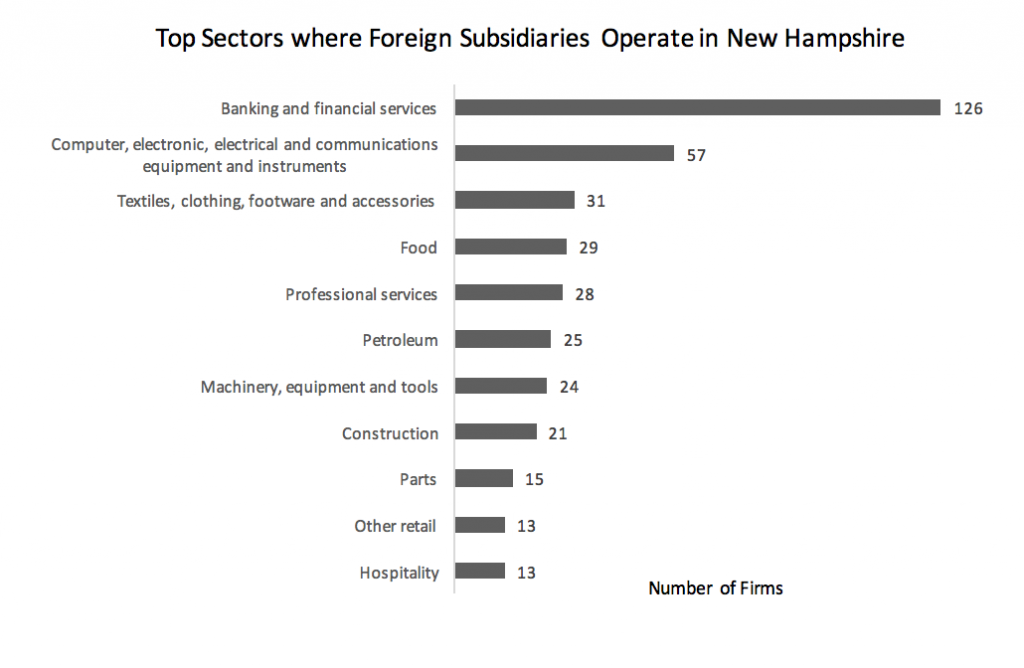

For allowing more possibilities for analysis, 20 sectors were created by the authors. The distribution of foreign firms across these sectors identifies the banking and financial services sector as the most populated. The sector that ranks next – computer, electronic, electrical and communications equipment and instruments – has about half the foreign firms. The subsequent sectors by number of foreign subsidiaries have single digit proportions of the entire sample of firms. Sectors not included in the visual representation below have 12 and under foreign firms each. The gas distribution and pharma sectors only have a few foreign subsidiaries each.

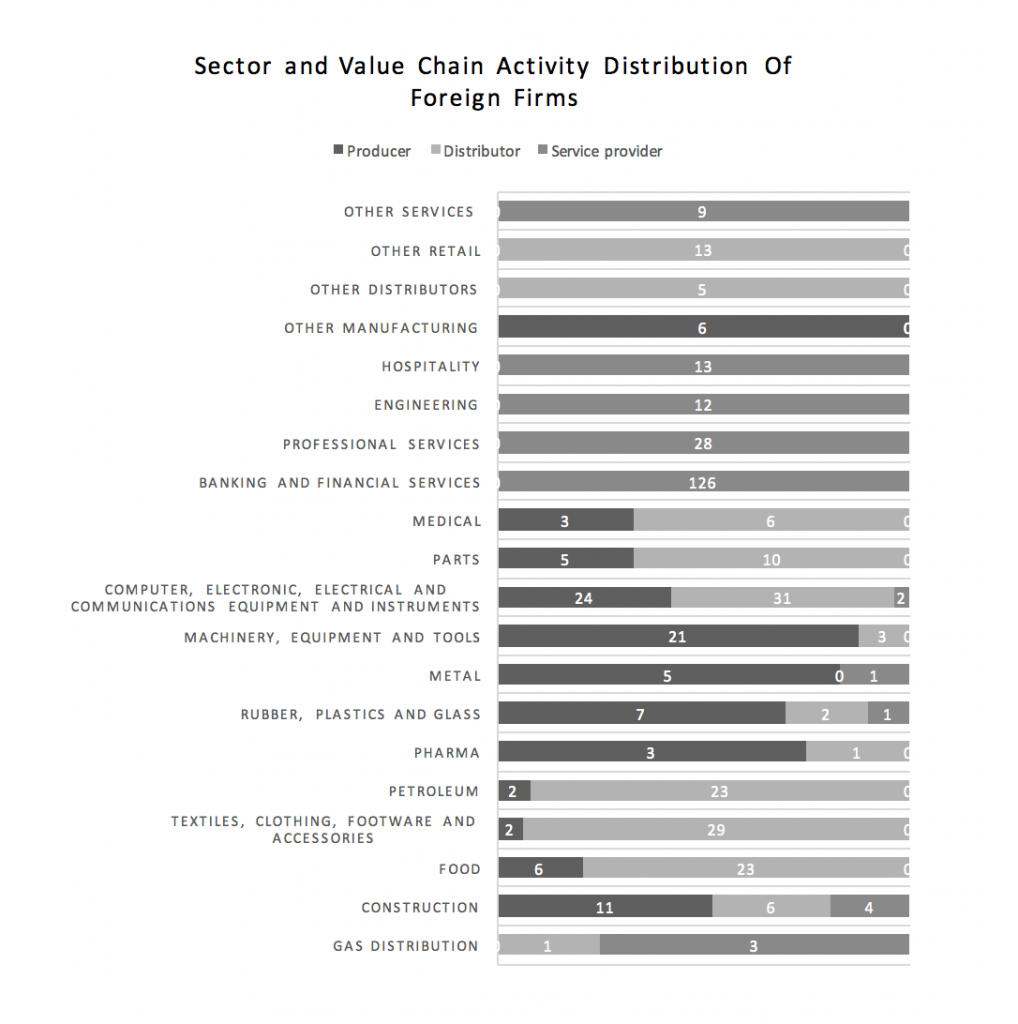

The visualization of the overlap of sectors and main value chain activities shown as follows recognizes the number of firms operating in sectors that are pure service, distribution or manufacturing. The relative distribution of value chain activities in other sectors reveals how foreign firms contribute to the value of products to the final users and consumers in New Hampshire. In 9 of the 20 sectors, foreign subsidiaries are represented with two main value chain activities. In 3 sectors, foreign firms are in all 3 of the general value chain activities considered. This may indicate that three sectors in New Hampshire have high potential for future investments, as foreign firms would find home-owned or international partners across the value chain: computer, electronic, electrical and communications equipment and instruments; rubber, plastics and glass; and construction. These sectors are also where foreign firms make most contributions across value chains in New Hampshire. Foreign subsidiaries play a relatively more important role in shaping products and in determining the value the ultimate buyers get from products in these sectors.