Foreign Manufacturers Influence New Hampshire’s Competitiveness

According to a recent report by SelectUSA[i], “the manufacturing sector in the United States has consistently been the largest recipient of FDI, attracting more FDI in the past 10 years than any other U.S. sector.” New Hampshire stands to benefit greatly from attracting more foreign manufacturers to establish operations in the state. The percentage of foreign manufacturers in the total number of foreign firms in New Hampshire is just over 20%. By numbers, manufacturers rank third as representation, behind finance and insurance, and retail trade. The presence of foreign manufacturers in many industries brings opportunities for further investments and new partnerships and business ventures.

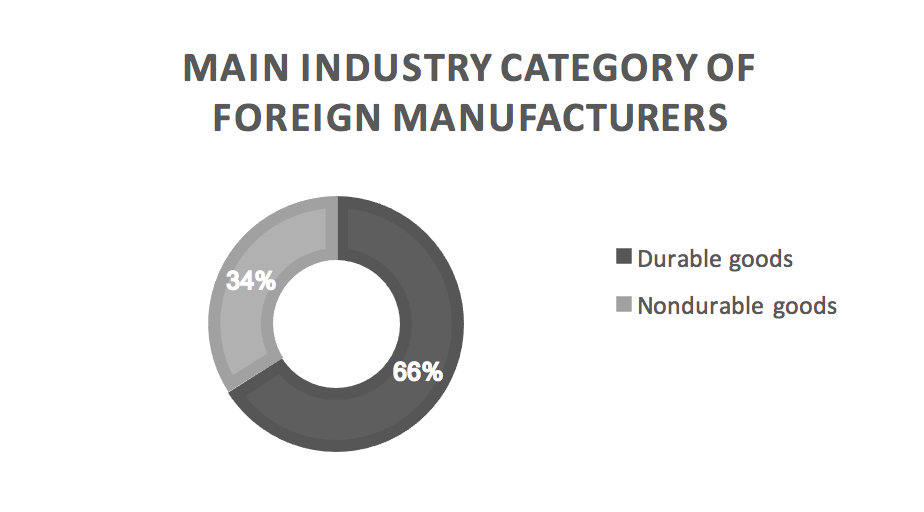

Replicating the manufacturing industry classification[ii] by the Bureau of Economic Analysis, the present analysis shows that the majority of foreign manufacturers in New Hampshire make durable goods.

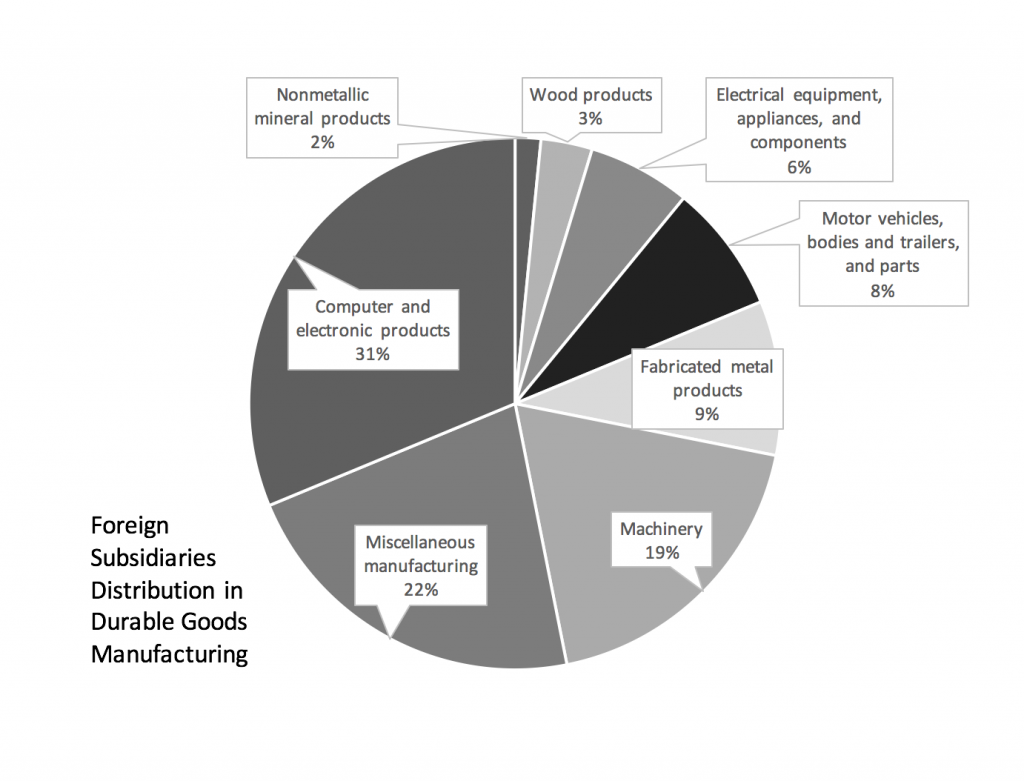

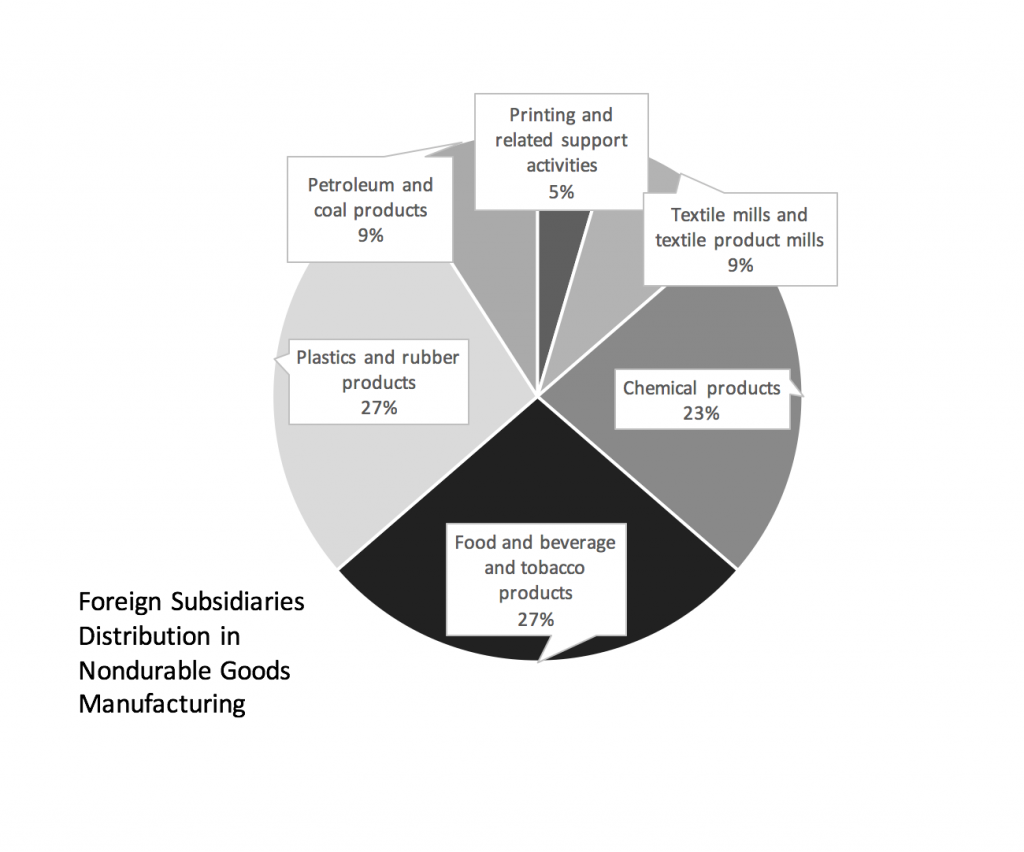

Most durable goods manufacturers are producing computer and electronic products. Miscellaneous manufacturing also makes up for a relative large proportion, followed by machinery manufacturing. 8 durable goods industries are represented. Nondurable goods foreign manufacturers are in 6 industries in New Hampshire, with the largest presence in plastics and rubber products manufacturing, and in food and beverage and tobacco products manufacturing. The number of foreign manufacturers of chemical products is also relatively notable.

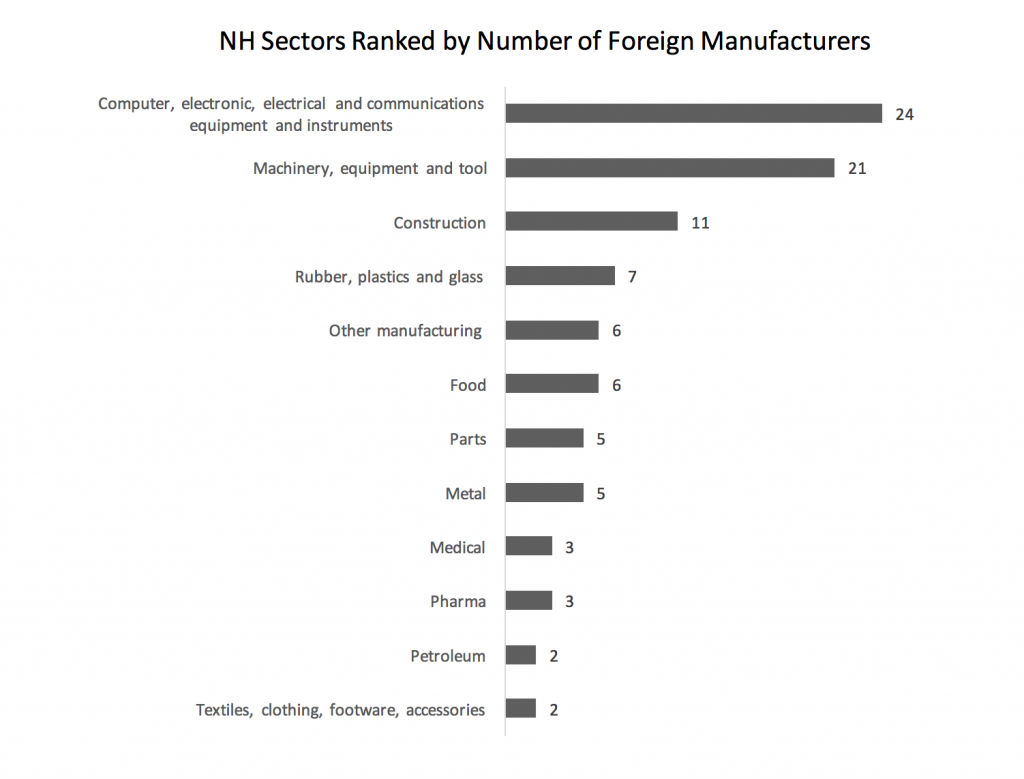

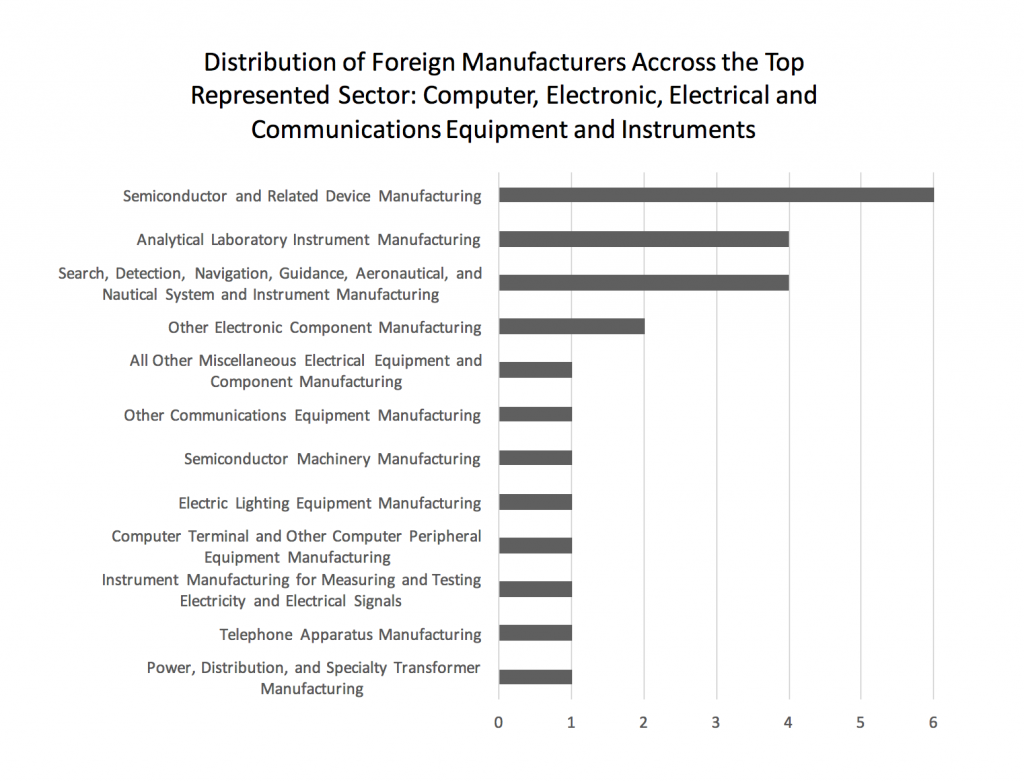

As noted in other parts of this report, 20 sectors were created by the authors. Computer, electronic, electrical and communications equipment and instruments is the sector of choice for most foreign manufacturers. About a quarter of manufacturing foreign firms operate in this sector.

The breakdown of the sector[iii] where most manufacturers operate identifies the relative strong representation in semiconductor and related device manufacturing. BAE SYSTEMS PLC subsidiaries presence dominates the industry of search, detection, navigation, guidance, aeronautical, and nautical system and instrument manufacturing. By representation across industries, the sector shows diversity.

The distribution in the second represented manufacturing sector, also shows diversity with low numbers of foreign firms across 10 industries. FREUDENBERG & CO. LLP subsidiaries have a sizeable presence.

As is the distribution of all foreign firms across New Hampshire counties, the highest number of foreign firms in manufacturing is in Hillsborough County, followed by Rockingham County. The differences in the numbers of firms across the top three represented counties are relatively high. The fewest manufacturers can be found in Belknap, Carroll and Coos.

Manufacturing may have a lot of realized and unrealized potential in New Hampshire. According to the Bureau of Labor Statistics[iv], manufacturing employment in the US has increased in the past year. SelectUSA states that “the manufacturing sector continues to receive the largest share of FDI-supported jobs in the United States”[v]. As indicated by the Office of the Chief Economist[vi], manufacturing compensation is higher than non-manufacturing compensation for foreign subsidiaries. In a recent interview[vii], local economist Russ Thibeault (Applied Economic Research) noted that New Hampshire has lost manufacturing jobs in recent years, but there is a recent increase in such jobs. He concluded that skilled labor is the draw for new manufacturing in the state.

The Office of the Chief Economist reports that the bulk of the R&D investments are in the manufacturing sector. As SelectUSA affirms[viii], “FDI in manufacturing greatly impacts the economy through its contributions to U.S. output and innovation. [..] This investment in R&D drives innovation, improvements in products and processes, and increased productivity gains.” Foreign manufacturers contribute to these aspects in our state, and to innovation and demand for highly skilled employees, particularly given that about half the manufacturing firms are in advanced industries.

Small foreign firms make an impact on many New Hampshire manufacturing industries. According to our sample[ix], most foreign manufacturers are small firms. Only 8% of firms have more than 500 employees. Like in many other sectors in the state, foreign manufacturers are entrepreneurial, and large foreign manufacturers make a significant impact on employment in the counties and industries where they operate.

Frequency of Scale [x] of Foreign Manufacturers in New Hampshire

| Percentage in total number of foreign manufacturers in NH | |

|---|---|

| Size class 1 (1 to 4 employees) | 20% |

| Size class 6 (100 to 249 employees) | 17% |

| Size class 4 (20 to 49 employees) | 14% |

| Size class 5 (50 to 99 employees) | 13% |

| Size class 2 (5 to 9 employees) | 11% |

| Size class 7 (250 to 499 employees) | 11% |

| Size class 3 (10 to 19 employees) | 7% |

| Size class 8 (500 to 999 employees) | 5% |

| Size class 9 (1,000 or more employees) | 3% |

Endnotes

[i] SelectUSA, FDI in Manufacturing, Advancing U.S. Competitiveness in a Global Economy, 2017. https://www.selectusa.gov/servlet/servlet.FileDownload?file=015t00000000gKi.

[ii] 3-digit level codes of The North American Industry Classification System (NAICS) as identified in https://www.bea.gov/industry/xls/GDPbyInd_VA_NAICS_1998-2009.xls.

[iii] Industries represented at the 6-digit level of The North American Industry Classification System (NAICS) codes, with descriptions from the classification.

[iv] Bureau of Labor Statistics, The Employment Situation —November 2017, https://www.bls.gov/news.release/pdf/empsit.pdf.

[v] Idem ii.

[vi] U.S. Department of Commerce Economics and Statistics Administration, Office of the Chief Economist, “Foreign Direct Investment in the United States”, October 3, 2017, https://www.esa.gov/sites/default/files/FDIUS2017update.pdf.

[vii] NH manufacturing on a roll again, WMUR Interview, Nov 26, 2017, http://www.wmur.com/article/nh-manufacturing-on-a-roll-again/13928660.

[viii] Idem ii.

[ix] A reduced sample includes employment data.

[x] Scale is identified as firm size class, as defined by the Bureau of Labor Statistics,https://www.bls.gov/bdm/bdmfirmsize.htm.